|

AsiaToday reporter Lee Ji-sun

South Korean companies are struggling to come up with countermeasures after the European Union (EU) came up with a draft of the Critical Raw Materials Act (CRMA) to cope with the U.S. Inflation Reduction Act (IRA). The CRMA has particularly posed challenges to South Korean automotive and battery companies, whose raw materials are highly dependent on China.

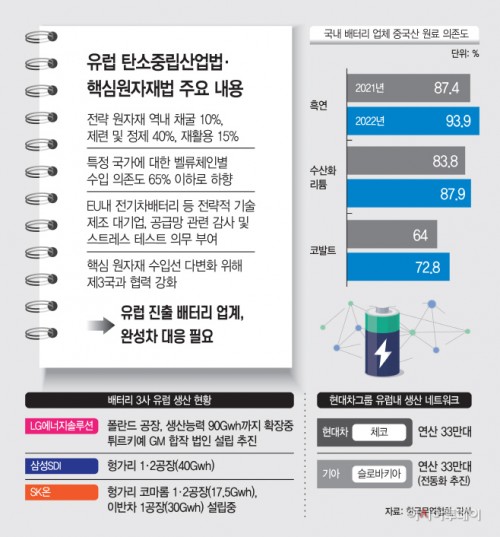

Under the draft version of the CRMA, which aims to secure critical raw materials and strengthen its manufacturing capabilities in the region, imports of strategic raw materials are to be limited to not more than 65 percent of the EU’s annual consumption by 2030. The plan is to reduce the EU’s dependence on Chinese products as it relies on more than 90 percent of major raw materials such as rare earths and lithium.

The EU plans to select 16 raw materials in consideration of future demand and strategic importance, and increase the proportion of mining and smelting in the region. The raw materials include nickel and cobalt, which are the main materials of batteries.

The business circle says the draft CRMA has no specific subsidy policies or provisions for offshore discrimination, but it has strengthened audits of local manufacturers, putting regulatory burden on the companies.

The EU has decided to give large companies that use strategic raw materials an obligation to monitor supply chains and conduct stress tests. It includes battery manufacturers and driving motor manufacturers. Domestic battery makers with production facilities in Europe and Hyundai Motor Group are also expected to be included in the audit.

“Demands for corporate information disclosure related to critical raw materials will be strengthened and requirements for permanent magnet recycling will be strengthened in the long run, putting companies on alert,” Cho Bit-na, head of Brussels Branch of the Korea International Trade Association, said.

#EU #CRMA #IRA #automakers #battery

Copyright by Asiatoday

Most Read

-

1

-

2

-

3

-

4

-

5

-

6

-

7